25+ mortgage deduction taxes

Ad File 1040ez Free today for a faster refund. See what makes us different.

Mortgage Interest Deduction Or Standard Deduction Houselogic

Web The IRS places several limits on the amount of interest that you can deduct each year.

. The deduction for mortgage interest is available to taxpayers who choose to itemize. Web The standard deduction is a fixed dollar amount that reduces the amount of income on which you are taxed. Taxes Can Be Complex.

12950 for tax year 2022 Married taxpayers who file. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately.

Code Notes prev next a Allowance of credit 1 In general There shall be allowed as a credit against the tax. For 2022 the standard deduction amounts are. It allows taxpayers to deduct interest paid.

Web Then you only get back any withholding taken out. For the 2022-2023 tax year the standard deduction. Ad Register and Subscribe Now to work on your Tax Deduction.

Web Standard deduction rates are as follows. Legal Forms with e-Signature solution. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Homeowners who bought houses before. The standard deduction is 19400. But for loans taken out from.

Web Mortgage interest. If you purchased your home after that. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Web The facts are the same as in Example 1 except that Bill used 25000 of the loan proceeds to substantially improve his home and 75000 to repay his existing mortgage. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Create Legally Binding e-Signatures on Any Device. Overall Limit As an individual your deduction of state and.

Web Refer to the Instructions for Schedule A Form 1040 and Publication 17 for more taxes you cant deduct. Also keep in mind the maximums According to. For the other 1098 or first mortgage select no.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Web If you purchased your home before December 15 2017 you can deduct payments on the interest for up to 1 million of your mortgage debt. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

2022 standard deduction amount. Single 12950 1750 or 65 and over or blind 14700 HOH. Web Is mortgage interest tax deductible.

We dont make judgments or prescribe specific policies. Web Current tax law states that your mortgage debt must be less than 750000 in order to deduct 100 of the mortgage interest. Web Most homeowners can deduct all of their mortgage interest.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Tax benefits of owning a home The. Code 25 - Interest on certain home mortgages US.

Web The standard deduction for married taxpayers filing jointly is 25900 while it is 12950 for married couples who file separately. Web How Does the Mortgage Interest Deduction Work. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

Single taxpayers and married taxpayers who file separate returns. Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe. In this case you must adjust your deduction to be equivalent to the portion of your home thats rented.

Taxes Can Be Complex. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web Here is the standard deduction for each filing type for tax year 2022. Web If you are on your most recent 1098 for new mortgage select Yes. Web Say you rent your basement to a tenant for the entire year.

Tax Tips Grass Roots Taxes

1bnvnogwqm0axm

Property Tax In Ireland The Ultimate Guide For Landlords

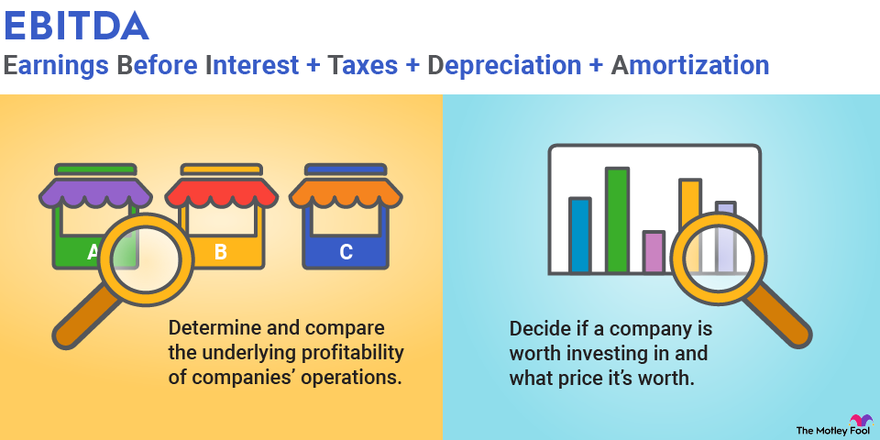

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

10 Tax Deductions To Maximize Rental Property Profits Azibo

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

When Is It Advantageous For A Tax Filer To Take The State And Local Tax Salt Deduction When Will It End Up Being A Liability If We Take It Since We Pay Federal

10 Tax Deductions To Maximize Rental Property Profits Azibo

Calculating The Home Mortgage Interest Deduction Hmid

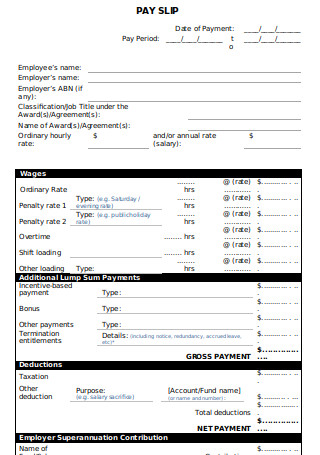

25 Sample Payroll Slip Templates In Pdf Ms Word

Mortgage Interest Deduction How It Calculate Tax Savings

How To Calculate Gross Income Per Month The Motley Fool

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Hud Vs Fha Loans What S The Difference

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

2020 Tax Deduction Amounts And More Heather

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Tax Lien How Does Tax Lien Work With Example And Impact